There’s nothing worse than being in the middle of selling your property only to be faced with (expensive) hidden costs you didn’t expect. Between agents fees, marketing costs and conveyancing, selling a home in Victoria can be quite pricey.

To prepare, you’ll need to know what the common expenses are. This article summarises these so you won’t be caught off guard when selling your home.

What Are The Upfront Costs Of Selling Your Property?

| Upfront Costs |

Price Range |

| Conveyancing |

$800 – $2,000 |

| Marketing |

$6,500 – $8,000 |

| Agent Fees |

1% – 3% of final sales price OR $4,000 – $10,000 |

Conveyancing

Conveyancing refers to the process of transferring the legal ownership of a property from one person to another. This is an unavoidable cost as it is required in every property purchase. You should set aside between $800 – $2,000 for conveyancing fees.

Marketing

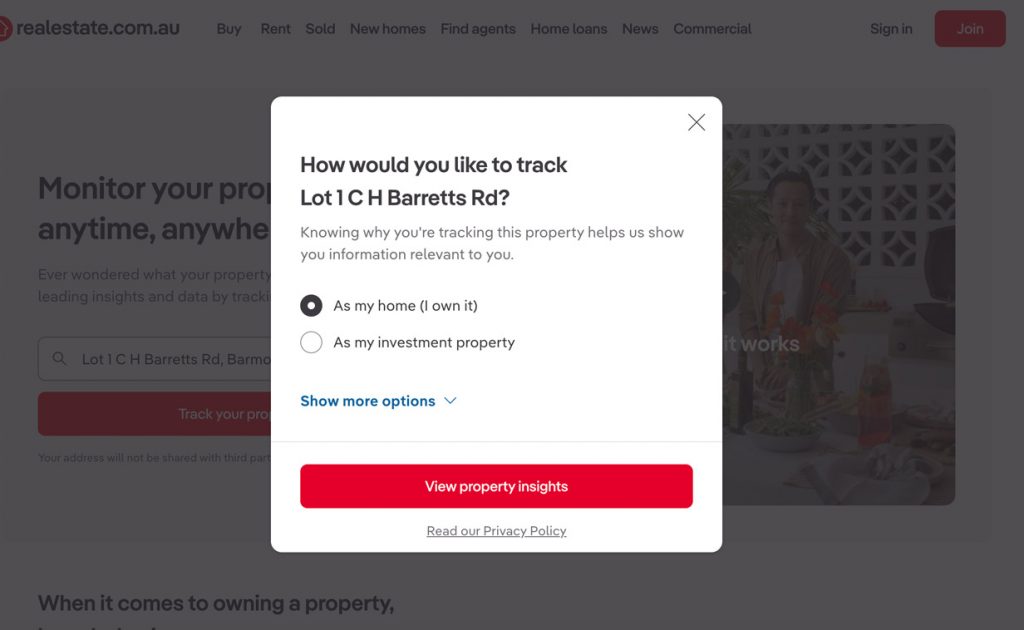

Marketing your property is a crucial part in selling it. While each marketing campaign is unique, you should be at the very least considering a basic marketing plan. This may include listing it on real estate websites, having a board in front of the property, press advertising and professional photography.

The average fees for marketing campaigns held in Melbourne in 2020 was between $6,500 – $8,000.

Agent Fees

Real estate agents typically take a percentage of the final price of the property as part of their fees. However, some agents also charge a flat fee which is agreed upon before the sale.

Commissions in the form of percentages usually ranges between 1% – 3%, but is influenced by a number of other factors like property value. As for flat fees, the range charged by real estate agents in Australia is between $4,000 – $10,000.

What Are The Hidden Costs Involved?

| Hidden Costs |

Price Range |

| Staging |

$2,000 and $8,000 |

| Moving |

$300 and $10,000 (depends on distance and number of items) |

| Legal fees |

$800 – $2,000 |

| Council rates |

Depends the councils annual budget and rateable properties in the area. Reach out to your conveyancer for this. |

| Bank fees |

$100 and $1,500 |

| Capital gains tax |

Depends on how much gains are made from your property sale. Reach out to your tax accountant for this. |

Staging

Styling or staging your home refers to dressing it up in preparation for a sale. This can involve redecorating, repairing lighting and fixtures, repainting and cleaning your home.

83% of real estate agents believe that a staged home sells faster and 50% say that staging can increase the property’s value by 1% – 15%. Staging your home can make a big difference to sales process and is considered a worthwhile investment. As the saying goes, you only have one chance to make a first impression. So, it’s best to make it count.

However, staging costs can be quite expensive, ranging between $2,000 and $8,000.

Moving

Moving costs are easily forgotten because this comes after the final settlement is completed. This cost typically depends on the number of items to be moved and the distance between places. But as an estimate, the cost of a move in Australia could be anywhere between $300 and $10,000.

Legal Fees

When selling your property, you may need to enlist the help of a conveyancer or solicitor. We’ve discussed what conveyancers do and how much they may cost, but solicitors are a little different.

Solicitors have broader legal knowledge and can assist with the agreements and legal documents pertinent to the sale. They can handle the complexities of property law in Victoria and ensure that your best interests are protected. The fees for this would range from $800 – $2,000.

Council Rates

Homeowners are responsible for council fees up until the day of settlement. Calculating council fees can get a little technical as this depends on the councils annual budget and rateable properties in your area.

Your conveyancer should be able to assist you in finding out how much council fees you’ll need to pay.

Bank Fees

Banks typically charge an early-exit and mortgage discharge fees for property sellers. This usually costs between $100 and $1,500.

Capital Gains Tax

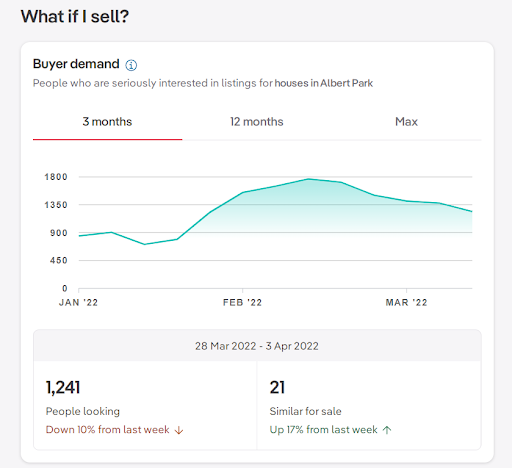

Capital gains tax is charged when selling an investment property or if a property is used to generate income. This is included in the seller’s taxable income.

The amount incurred depends on how much gains are made from the sale of the property and costs incurred from owning the property. This is something that your tax accountant can assist you with.

What Costs Can You Save On? And Should You?

Mandatory Costs

Fees that you won’t be able to avoid include:

- Legal fees

- Council rates

- Bank fees

These are costs that you’re required to pay when selling any property so it’s ideal to set aside some funds for these.

Optional Costs

Fees that are optional when selling your property include:

- Marketing expenses

- Staging/styling costs

- Real estate agent fees

- Capital gains tax (CGT)

While these expenses are optional, it does not necessarily mean you should go without them.

Marketing Expenses

A basic marketing campaign for example is somewhat necessary as you’ll need to inform potential buyers that your home is for sale. However, each listing is unique and you can and should set a budget for how much you’re willing to spend on marketing costs.

Staging Costs

Staging costs, as we’ve learned, can be one of the best things you can do to prep your home for a sale. While not mandatory, staging a home can increase the value of the property and make the sales process a lot quicker. Similar to a marketing campaign, you should set a realistic budget for how much you can afford to spend on staging expenses to ensure you don’t entirely lose out on its benefits.

Real Estate Agent Fees

Hiring a real estate agent is another optional cost you can consider when selling your home. Most people are too busy with their day jobs and managing a family to be fully committed to selling their home, which is where real estate agents come in handy. To decide, you will have to consider the opportunity cost of selling the property on your own to hiring an agent.

Capital Gains Tax

There are a couple ways you can minimise paying capital gains tax (CGT)*:

- Own the asset for at least 12 months

- Make the property your main residence

- Sell during a low income year

The first two points above are relatively straightforward. As for the third point, it refers to timing the sale of your property during a low income year so that it lowers your marginal tax rate and reduces your CGT liability. But to do this, you’ll need to plan well ahead.

*That said, don’t forget to consult your tax advisor for more detailed information.

Out Of Sight, Out Of Mind?

The key to ensuring that you don’t get any nasty surprises when you’re selling your property is to stay on top of your expenses from the very beginning. The good news is that after reading this article, these costs are not-so-hidden to you anymore.

Start off by mapping out what you’ll need to pay for when selling your home and how you intend to fund these expenses. Along the way, you may find ways to minimise certain costs.

Managing the financial aspects of selling your home can be tricky, which is why CT Real Estate is here to help. Our dedicated team of professionals will do their best to save you the time, money and stress involved with all things real estate.